Our last profile exploded double digits during the session and saw several big swings during the session.

We have another profile that we want you to research immediately. It is sitting at just .10 with some potential upside.

Pull up KULR Technology Group Inc (NYSE: KULR) right away and put it on your screen for tomorrow’s session.

KULR Technology Group Inc (NYSE: KULR) develops and commercializes high-performance thermal management technologies for batteries, electronics, and other components across an array of battery-powered applications. As the global economy becomes increasingly electrified and connected, KULR is addressing the rising demand for cooler, lighter, and safer batteries, and electronic systems. Leveraging the company’s roots in developing breakthrough cooling solutions for NASA space missions and backed by a strong intellectual property portfolio, KULR provides customers with industry-leading battery safety technologies as well as cost-effective cooling technologies that outperform traditional solutions. The world’s leading aerospace, electronics, energy storage, 5G infrastructure, and electric vehicle manufacturers trust KULR to solve safety, reliability, and efficiency challenges in an ethical and environmentally sustainable manner.

Active government initiatives propelled by industry and regulatory tailwinds are increasing demand for battery recycling and clean energy, resulting in an expanding total addressable market for KULR’s solutions. The Company’s disruptive technologies strive to fulfill an addressable $24 billion thermal management systems market (estimated based on market data projections published by Converged Markets stating that the thermal management systems market size was projected to grow from $11.1 billion in 2017 to $24.8 billion by 2025. KULR’s integrated design approach offers comprehensive solutions in thermal interface materials, lightweight heat exchangers, and protection against lithium-ion battery thermal runaway propagation. Its high-performance solutions can be designed to fit demanding configurations and applications.

As companies and governments around the world pledge to meet net zero emissions over the next few decades, KULR is uniquely positioned to accelerate the adoption of clean energy solutions and sustainable products and facilitate the migration to a global circular economy. The Company’s goal is to provide total battery safety solutions for more efficient battery systems, increased sustainability, and end-of-life battery management, making KULR a key technology solutions provider in the migration to a global circular economy.

CATALYSTS

- Leveraging KULR’s roots in developing breakthrough cooling solutions for NASA space missions and backed by a strong intellectual property portfolio, KULR provides customers with industry-leading battery safety technologies as well as cost-effective cooling technologies that outperform traditional solutions.

- KULR is currently processing up to 10,000 lithium-ion cells per week as well as preparing for tests performed by NASA, the Department of Defense (“DoD”), and others performing manned flighted missions.

- KULR was awarded three additional contracts with DoD prime contractors to implement the Company’s carbon fiber cathode solution for high-power magnetic and other covert pulse weaponry initiatives.

- KULR also secured a new battery safety contract with NASA to test its lithium-ion cells for future battery packs designed for the Artemis Program, a series of US-led international human spaceflight programs.

- KULR recently appointed former NASA Johnson Space Center senior leader Dr. William Walker as Director of Engineering.

- KULR expects to procure lithium-ion battery cells providing up to 500-megawatt hours (“MWh”) of energy capacity, enough to power approximately 40,000 homes.

- KULR just received a follow-on phase change material heat sink order from Lockheed Martin

- KULR has partnered with Lockheed Martin, Leidos and other prime contractors to develop and supply mission-critical technologies for hypersonic vehicles, high-power magnetic wave, and other defense systems.

- KULR’s portfolio of thermal management solutions target air and liquid-cooling of high-performance computing applications such as crypto mining, cloud computing, AI, and AR/VR simulations to maximize performance, energy efficiency and safety.

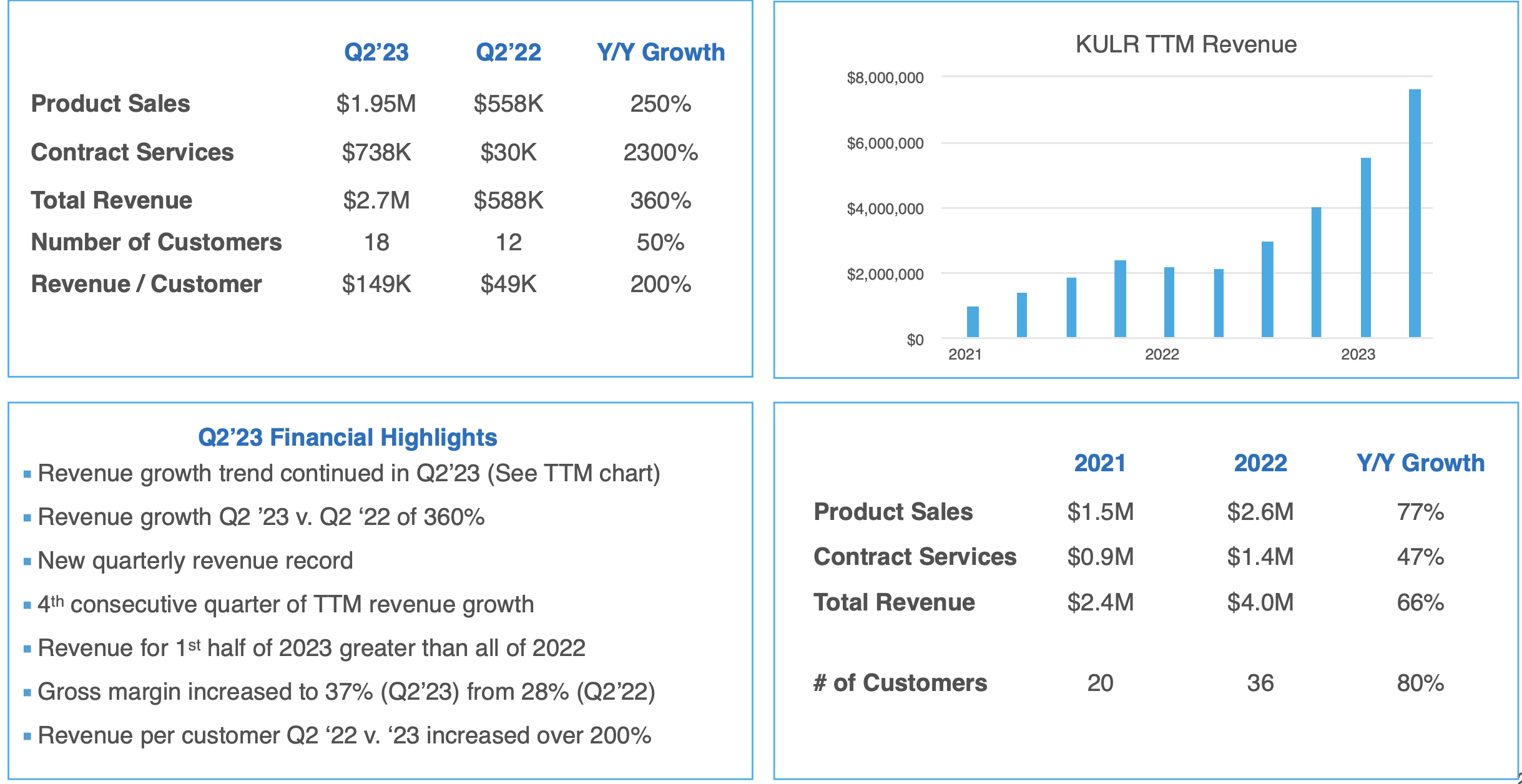

RECENT FINANCIAL HIGHLIGHTS

- KULR posted another record quarter, the second in a row, adding to the record setting revenue of the second quarter. Revenue for the quarter was approximately $3 million compared to approximately $1.4 million in the third quarter last year.

- This represents approximately 120% increase or more than doubling of revenue, comparing the two periods. For the first nine months of 2023. KULR generated approximately $7.5 million of revenue compared to approximately $2.1 million in the first nine months of 2022 for approximately a 245% increase or more than a tripling of revenue, comparing the same periods.

- Product revenue this quarter was approximately $1.9 million, up about 38% from the same quarter last year. Our service revenue this quarter was approximately $1.1 million up about 4,800% from the same quarter last year. As Mike mentioned earlier, our service revenue can be viewed as a foreshadowing of scalable product revenue opportunities.

- Their gross margin for the third quarter was 44%, up from 33% in the same period last year. Achieving a gross margin in the mid 40s has been a goal of the KULR team. We continue to work to increase our gross margin based on revenue mix, pricing, and additional scale.

- Revenue per paying customer in the quarter was almost $170,000, up approximately 94% versus the same quarter last year. For the nine months ending Q3, our revenue per paying customer was over $200,000, up approximately 170% with the number of paying customers growing to 37% up 28% from the same nine-month period last year.

- Revenue per employee in the quarter was approximately $43,000, which is up 14% from the second quarter and 70% from the first quarter of this year, indicating increasing human capital productivity.