FingerMotion, Inc. (NASDAQ: FNGR) is steadily gaining attention from online investors as the company takes a stand against potential fraudulent short activity. We’ve previously covered FNGR, most notably in articles from July and September. However, the latest developments are too significant to ignore, prompting us to revisit the subject. Just recently, FNGR issued a press release announcing a federal lawsuit against a short-selling research firm, Capybara Research. In this article, we delve into the events of the past month to better understand FNGR’s potential trajectory moving forward.

Federal Lawsuit:

Following our previous report in September, FNGR experienced an additional 43% surge in its stock price shortly afterward. At the same time, the company has been targeted by numerous intense bear raids, fuelling frustration among retail investors.

Many of these investors have voiced concerns about potential fraudulent activities occurring in broad daylight and have reported these concerns to the SEC. However, as of now, there has been no visible response or change in the situation.

After appointing attorney Mark R. Basile and The Basile Law Firm P.C. to investigate their stock’s recent performance, FNGR swiftly unveiled a lawsuit against the short selling research firm Capybara Research. Here’s a concise update:

As of October 20th, 2023 FNGR filed a federal lawsuit against Capybara Research in the United States District Court for the Southern District of New York. The lawsuit alleges that Capybara intentionally published a defamatory article to manipulate FingerMotion’s stock and profit from a short position, with claims of securities fraud violations, defamation, and business interference under federal and state laws. The company has taken this legal action in response to concerns about unlawful interference with its public market.

CEO Martin Shen stated, ‘We are committed to understanding the recent stock fluctuations and are taking steps to protect our shareholders.’

It’s important to note that Mr. Basile is a former law professor who has been actively involved in combatting dilution funding for the past 8 years. In 2021, his firm achieved a significant legal victory against a toxic lender, setting a precedent that has saved many public companies tens of millions of dollars. Since then, they have successfully appealed several federal trial court judgments, leading to a reduction in lawsuits by dilution funders against public companies in the past 18 months.

His arrival couldn’t have come at a more crucial juncture. The company can now harness his expertise to unveil the veiled complexities that retail investors have tirelessly sought to illuminate over the past several months. Could Basile be the force that ultimately quashes potential fraudulent activities once and for all? Stay tuned for potential developments on this front tomorrow, October 25th, 2023.

Subscribe to Microcapdaily.com Right Now by entering your Email in the box below.

Important Date, October 25th, 2023:

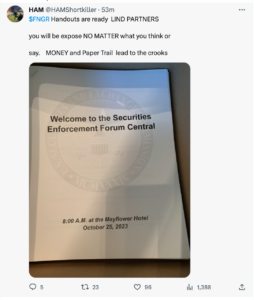

Another leading reason behind writing about FNGR today is the fact that the SEC will be holding their annual securities enforcement forum tomorrow on October 25th, 2023.

The conference features a distinguished panel of experts, with nearly a dozen senior SEC enforcement officials and over 30 renowned figures in the securities enforcement arena. They will delve into paramount issues in securities enforcement, encompassing areas such as cryptocurrency, whistleblower cases, financial and accounting fraud, the influence of artificial intelligence (AI), advanced tactics for litigation and investigation, handling SEC-linked legal matters, financial institutions, insider trading, climate concerns, cybersecurity, and a wide array of other topics.

Most importantly, there will be a keynote address by SEC Chair Gary Gensler, followed by a Q&A session, as well as a keynote discussion with SEC enforcement director, Gurbir Grewal.

With FNGR attracting considerable scrutiny from retail investors who are not only reaching out to SEC Chair Gensler personally but also voicing their concerns to the SEC as a whole, the need for a direct response to this matter is becoming increasingly evident.

According to @HAMShortkiller on Twitter, the stock now has a naked short of 200,000,000 shares to buy back. The SEC surely must address and resolve the matter conclusively or at the very least provide some form of insight into their intended course of action during the meeting tomorrow.

Subscribe to Microcapdaily.com Right Now by entering your Email in the box below.

Financial Update:

FNGR also released its financial results for the second quarter of fiscal 2024, ending on August 31, 2023 on October 16th, 2023. The highlights of this report include:

- Quarterly revenue of $9.28 million, marking an 86% increase compared to Q2 of fiscal 2023.

- A significant increase of $6.38 million (227%) in revenue from the Telecommunications Products & Services business compared to Q2 of fiscal 2023.

- Quarterly Big Data revenue reached $.77 million, an improvement over the $.63 million reported in Q2 of fiscal 2023.

- A gross profit of $1.84 million, marking a significant increase of 341% compared to Q2 of fiscal 2023.

- Quarterly loss of $134,081, representing a 1.40 million decrease or 91% compared to Q2 of fiscal 2023;

- As of August 31, 2023, FingerMotion had $4,043,279 in cash, a working capital surplus of $14,031,352, and shareholders’ equity of $14,198,601.

- The total assets amounted to $20.30 million, total current liabilities were $6.08 million, and total liabilities were $6.08 million.

- The company had 52,381,952 common shares issued and outstanding as of August 31, 2023.

Navigating the intricacies of a diverse product line, the company successfully enhanced its profit margins. In alignment with their strategic objectives, they are now potentially on the brink of achieving breakeven. Should this positive trajectory persist, upcoming earnings may well mark a profitable milestone.

Short Squeeze Potential?:

In order to adhere to compliance regulations, we should avoid making speculative statements regarding FNGR’s potential to trigger a “Short Squeeze.” However, it’s worthwhile to explore the perspective of a noteworthy advocate of FNGR. We’ve previously discussed HAMShortkiller, and this discussion remains pertinent for good reason.

@HAMShortkiller was among the first to recognize the short squeeze potential of GameStop Corp. (NYSE: GME) as early as February 20, 2020, earning significant recognition on Twitter for this insight. GME, as you may recall, became a battleground where retail investors fiercely contested notable hedge funds, marking a pivotal moment in financial markets.

The same user is now committed to seeking justice for FNGR shareholders, and is driven by concerns over the significant volume of naked shorting associated with the stock. Most importantly, @HAMShortkiller will be attending the SEC conference tomorrow on October 25th, 2023 to ensure that compelling evidence takes the spotlight before Gary Gensler and the SEC. The user contends that Jeff Easten, the founder of Lind Partners, should take the utmost care with the evidence if he wishes to safeguard his interests.

As mentioned previously, there has been talk of “substantial evidence” that is quite conspicuous, as noted by various users on Twitter. To illustrate this, we find it relevant to showcase a screenshot from a Twitter user, revealing the bid and ask orders for FNGR. The stock’s performance, as depicted in the Level 2 data, is undeniably perplexing. @TiaBolt2t underscores the importance of “following the money” and suggests that Lind Partners is working some sort of financial alchemy.

Conclusion:

We strongly advise keeping a close watch on FNGR’s developments tomorrow, particularly during discussions involving the SEC and Gary Gensler at the securities enforcement forum. @HAMShortkiller may well thrust FNGR into the spotlight as they persist in raising concerns and presenting compelling evidence against parties potentially involved in fraudulent activities affecting FNGR’s stock performance.

Coupled with @HAMShortkiller’s presence at the event, will be Mark R. Basile. Where he plans to meet with several high ranking officials “To discuss market issues plaguing retail investors and the public markets”. Should more notable events transpire in the near term regarding FNGR, we’ll be sure to cover it. Stay tuned for updates.

We will update you on FNGR when more details emerge, subscribe to Microcapdaily to follow along!

Disclosure: We have not been compensated for this article/video. MicroCap Daily is not an investment advisor; this article/video does not provide investment advice. Always do your research, make your own investment decisions, or consult with your nearest financial advisor. This article/video is not a solicitation or recommendation to buy, sell, or hold securities. This article/video is our opinion, is meant for informational and educational purposes only, and does not provide investment advice. Past performance is not indicative of future performance.

Picture by WilliamCho from Pixabay

Uncategorized3 years ago

Uncategorized3 years ago

Micro Cap Insider4 years ago

Micro Cap Insider4 years ago

Media & Technology5 years ago

Media & Technology5 years ago

Featured2 years ago

Featured2 years ago

Media & Technology5 years ago

Media & Technology5 years ago

BioPharma4 years ago

BioPharma4 years ago

Uncategorized3 years ago

Uncategorized3 years ago