CS Diagnostics Corp. (OTC: FZRO) has seen a remarkable 112% surge in its shares as of the current moment, marking a staggering total gain of 432% since November 15th, 2023. Interestingly, despite this significant increase, the company hasn’t released any press statements and we cannot find any respective SEC filings that could account for such a surge.

The absence of an investor relations section on the company’s website limits the available avenues for gathering insights. Nonetheless, we managed to uncover additional information through online forums among retail investors and a supplemental filing from the OTC markets website, posted from FZRO’s Twitter.

While these sources have provided some background, the lack of formalized information leaves us with relatively little to base our analysis on. Nonetheless, despite its recent nature, the supplementary OTC filing dated November 27th, 2023, could potentially offer a preview of FZRO’s future prospects and the potential trajectories it might pursue.

Background:

Background:

On September 4, 2023, CS Diagnostics Corp made a significant acquisition. They purchased the entire CS Protect-Hydrogel, including its tangible product, intellectual property, distribution rights, and patents from the CS Diagnostics Group, a company based in Germany. This hydrogel-based tissue spacer serves a crucial purpose in radiation therapy by creating distance between cancerous cells and healthy tissue. Essentially, it shields healthy tissue from the harmful effects of high doses of radiation.

Hydrogel Spacers:

Currently hydrogel spacers are specifically used in treating prostate cancer. In this case, the spacer helps in moving the rectum away from the prostate, thereby decreasing the damage caused to the rectum during radiation therapy. This hydrogel spacer is injected in liquid form through a thin needle into the area between the cancer cells and healthy tissue. It gradually dissolves within the body after approximately 6 months.

What’s unique about CS Protect-Hydrogel is that it’s a ready-to-use product, sterilely packed and can be directly applied. Moreover, this hydrogel can be beneficially utilized in radiotherapy treatments for a wide array of cancers such as prostate, cervical, esophageal, bladder, and breast cancers.

Competitive landscape:

Good news, there does not appear to be a highly competitive landscape for this technology. FZRO’s main competitor for hydrogel spacers would be Boston Scientific Corporation (NYSE: BSX), currently valued at USD $80 billion. The competitor product SpaceOAR Hydrogel System was developed in 2010 by Augmentix, Inc., which was fully acquired by Boston Scientific Corporation in 2018 for a fixed purchase price of USD $500 million plus a variable purchase price component of USD $100 million upon achievement of certain sales targets.

The competitor product has been further developed, and is currently marketed under the SpaceOAR Vue Hydrogel trademark, and is approved exclusively for use in prostate radiation. The product marketed by BSX consists of three components that are mixed in a predetermined sequence and drawn into a syringe by a trained and skilled person.

It’s important to note that the molecule of the CS Protect-Hydrogel differs significantly from the molecule of the competitor product, and patent infringements are not to be expected.

Subscribe to Microcapdaily.com Right Now by entering your Email in the box below.

Competitive Edge:

According to FZRO, their product is highly differentiated from BSX and comes with several advantages, specifically:

Practical Benefits:

- Effortless application of CS Protect-Hydrogel as it comes pre-prepared, simplifying the process.

- Eliminates any additional work steps.

Hygienic Advantages:

- Immediate application of CS Protect-Hydrogel upon removal from sterile packaging, minimizing the risk of contamination.

- Prevention of contamination from product preparation and assembly.

- Reduction of potential hygienic risk areas within the treatment room.

Medical Benefits:

- Elimination of the risk of incorrect mixture, preventing potential missed patient appointments.

- Expanded application across various cancers (prostate, cervical, esophageal, bladder, and breast), enabling a broader range of treatments.

- Feasibility of hypofractionation, reducing the number of treatment sessions per patient.

- Potential for dose escalation, facilitating acceleration of radiation therapy.

Economic Benefits:

- Reduced personnel costs during treatment by removing the need for assistance in hydrogel mixing.

- Lower room utilization costs per patient due to decreased risks of re-treatment from incorrect mixtures.

- Decreased cleaning expenses due to the ready-to-use nature of the product.

- Minimized lawsuits or insurance claims resulting from incorrectly mixed hydrogels, reducing additional treatment requirements.

- Lower purchase price for clinics compared to competitor products.

With easier handling, lower medical & cost risks, and expanded scope of application, FZRO expects that the respective purchasing departments of clinics (including specialty clinics) and hospitals will quickly adopt and list the CS Protect-Hydrogel in their portfolios.

Market Opportunity:

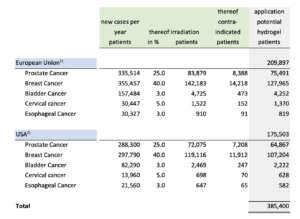

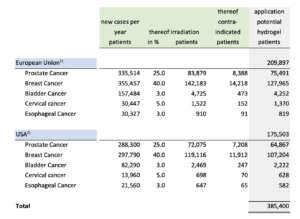

Apart from the CS Protect-Hydrogel, a competitor product enjoys widespread global use. The CS Diagnostics Group is confident that the CS Protect-Hydrogel could capture around 50% of the market share in the near future. This confidence stems from the aforementioned easier handling, reduced medical and cost risks, and broader range of applications.

The success of the CS Diagnostics Group’s use of CS Protect-Hydrogel relies heavily on how well it enters the market and the share it captures.

In a realistic scenario where it achieves a 50% market share and respective sales prices of EUR $1,100 and USD $1,900 per unit, the economic benefit as the net present value of future cash surpluses as of September 30, 2023 is a monumental EUR $961 million.

For more information on how this was calculated, click here.

Valuation & Audit:

On September 4, 2023, Tom Wrankmore, a reputable German public auditor and valuation firm, conducted an assessment certifying the value of the CS Diagnostics Hydrogel product, all previously mentioned values were taken from Wrankmore’s assessment.

It’s important to remember there’s a number of x factors involved in the valuation of FZRO, and the values calculated could be no where close to accurate if things do not go according to plan.

Considering Wrankmore’s credible expertise and esteemed status, he perceives this scenario as a plausible one. However, the successful execution ultimately falls on the management team.

It’s crucial to delve into the team’s background and track record to gauge the potential outcome accurately. Presently, there’s limited information available about the management team, which isn’t necessarily a surprise, given how recent FZRO was established.

Subscribe to Microcapdaily.com Right Now by entering your Email in the box below.

Acquisition & Approvals:

On September 27, 2023, CS Diagnostics Corp acquired the entire CS Protect-Hydrogel for a cost basis of Five Hundred Million USD. This acquisition was completed through the issuance of 110,000,000 shares of CS Diagnostics Corp Common Stock. Following this transaction, in November 2023, CS Diagnostics Corp submitted its 3rd Quarter Report and Financial Statements, emphasizing the acquisition of the CS Protect-Hydrogel.

This submission aimed to clarify that the company is no longer categorized as a shell company and should not be considered a “Shell Risk.”

At present, the company is actively collaborating with its partners to secure regulatory approval for CS Protect-Hydrogel from key authorities across Europe, North, and South America. This critical step is essential for the product’s recognition and acceptance in medical applications within these regions.

Following successful CE testing and certification in Germany, the process of registration or approval involves a necessary testing procedure. Anticipating the regulatory journey, the CS Diagnostics Group expects a timeframe of 6 to 12 months for approval in the U.S. Additionally, a timeline of 6 to 8 months is foreseen for the testing procedure and registration of CS Protect-Hydrogel in Germany.

Considering the existing market availability of a competitor product used worldwide specifically for prostate irradiation, CS Protect-Hydrogel does not require extensive re-introduction or advertisement for this particular application. However, extensive information dissemination and promotional efforts are crucial for establishing its use in treating other types of cancer.

Conclusion:

Obviously FZRO is still in its early phases, but Wrankmore’s assessment has certainly made it quite attractive. While it’s currently too soon to tell, we can imagine part of FZRO’s exit strategy may consider a bigger player like Boston Scientific Group (NYSE: NSX) buying them out – this all depends on how FZRO progresses and is merely speculation for now.

The recent OTC filing on November 27th, 2023, has caught the eye of many retail investors, sparking interest in the stock. Volume is picking up extremely quickly and we might not see these low levels for long. FZRO’s average trading volume is 4,514 shares and had 179,680 shares traded at the time of writing – a near 40X increase in volume after Wrankmore’s assessment.

Over the next 6 to 8 months, we expect to gain clearer insights into how well the management team can meet Wrankmore’s expectations. Regardless, we strongly advise closely monitoring FZRO during this pivotal period, as developments tend to evolve rapidly.

We will update you on FZRO when more details emerge, subscribe to Microcapdaily to follow along!

Disclosure: We have not been compensated for this article/video. MicroCap Daily is not an investment advisor; this article/video does not provide investment advice. Always do your research, make your own investment decisions, or consult with your nearest financial advisor. This article/video is not a solicitation or recommendation to buy, sell, or hold securities. This article/video is our opinion, is meant for informational and educational purposes only, and does not provide investment advice. Past performance is not indicative of future performance.

Picture by vipragen from Pixabay

Uncategorized3 years ago

Uncategorized3 years ago

Micro Cap Insider4 years ago

Micro Cap Insider4 years ago

Media & Technology5 years ago

Media & Technology5 years ago

Featured2 years ago

Featured2 years ago

Media & Technology5 years ago

Media & Technology5 years ago

BioPharma4 years ago

BioPharma4 years ago

Uncategorized3 years ago

Uncategorized3 years ago