Street Watch

88 Energy Ltd (OTCMKTS: EEENF) Run Brewing as PeregrinOil Miner Targets 1.638 bbl in World Class Alaska North Slope

Published

3 years agoon

By

Boe Rimes

88 Energy Ltd (OTCMKTS: EEENF) continues to move steadily higher over its $0.02 base with power in recent days as volume picks up heavily. EEENF is emerging as an investors favorite and is currently among the most actively searched and talked about stocks in small caps. Currently under heavy accumulation EEENF is moving steadily northbound with many new investors buying in every day. EEENF is looking to blaze a path along the likes of Enzolytics or Tesoro and break out into a whole new dimension – Tesoro went to multi dollars – EEENF is looking to take out $0.085 recent highs for confirmation of the next leg up and blue sky breakout!

88 Energy is a big story developing in smalll caps; The recent acquisition of XCD Energy gives the Company over 400,000 acres in the world class North Slope of Alaska estimated by the USGS in 2005 to hold more than 50 billion bbl of oil and a war chest of $13 million in the treasury. Timing could not be better for a potential mammoth oil strike with the Crude Oil WTI Index continuing to rise. 88 Energy recently commenced drilling the Merlin-1 well which will initially be drilled to 1,500 feet, then surface casing will be installed, and the Blow Out Preventer System tested. the well will be deepened through the target horizons in the Nanushuk Formation to a maximum total depth of 6,000 feet. 88 Energy has recently received initial results from 5 of the 18 specifically selected trims from the side wall cores, with 2 of the 5 confirming the presence of hydrocarbons. Significantly, these depths were among the prospective zones that were not able to be tested with the RDT downhole fluid extraction tool. These zones also correspond with depths where good oil shows were noted during drilling, including petroliferous odour, fluorescence and cut. Small trims were cut from the side of several of the 48 side wall cores to undergo special analysis. The remaining material is reserved for routine core analysis.

88 Energy Ltd (OTCMKTS: EEENF) is an oil and gas operator with 3 properties covering over 400,000 acres of targeting the world class North Slope of Alaska estimated by the USGS in 2005 to hold more than 50 billion bbl of oil and natural-gas liquids and 227 trillion cubic feet of gas. The recent merger of 88Energy and XCD Energy has created a substantially enhanced Alaska focused oil exploration and appraisal Company currently making big moves. All three projects combined total about 410,312 acres in northern Alaska that hold significant potential of future growth and discoveries. 88E is listed in Australia, London and the USA as EEENF With 88 Energy targeting 1.638 bbl and analyses on the projects coming in late Q1, 2021 anticipation could not be greater.

EEENF has an impressive shareholder list:

Project Icewine, Alaska covers 200,000 acres onshore in a prolific oil-rich province. The land was confirmed to have large oil and condensate repositories and is expected to be further appraised for more accurate findings. The project site has a 78% working interest and would be leased for 7-10 years with a 16.5% royally for the land holders. nconventional objective in shale complex that sourced the 13 BN barrel Prudhoe Bay Oil Field – opportunity identified by first mover in the Eagle Ford; onventional objective is the hottest play on the North Slope with 88 Energy acreage offset by multiple recent discoveries.

Project Icewine, Alaska covers 200,000 acres onshore in a prolific oil-rich province. The land was confirmed to have large oil and condensate repositories and is expected to be further appraised for more accurate findings. The project site has a 78% working interest and would be leased for 7-10 years with a 16.5% royally for the land holders. nconventional objective in shale complex that sourced the 13 BN barrel Prudhoe Bay Oil Field – opportunity identified by first mover in the Eagle Ford; onventional objective is the hottest play on the North Slope with 88 Energy acreage offset by multiple recent discoveries.

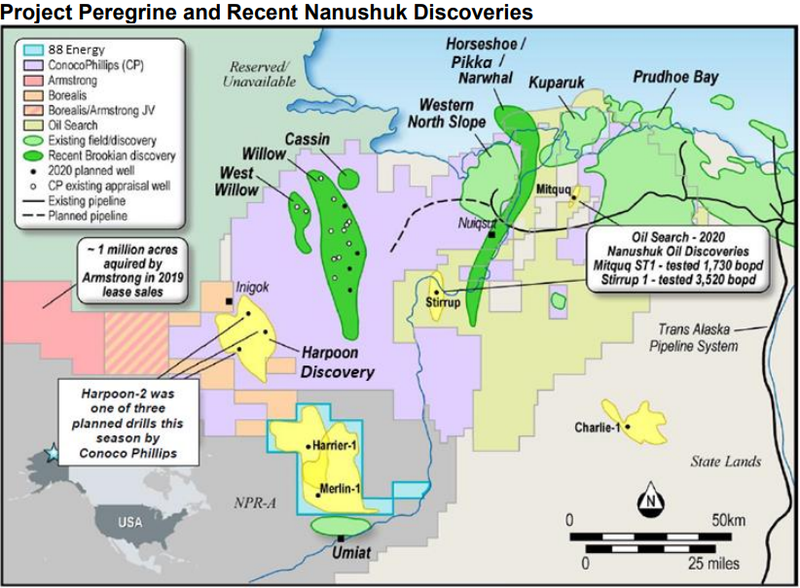

Project Peregrine in Alaska spans about 195,000 acres and is fully owned by EEENF in NPR-A. The site was recently acquired via the arket takeover of XCD Energy Ltd. Large prospects on trend to recently discovered fields; US$10m farm-out completed post XCD acquisition; Drilling to commence March 2021.

Project Peregrine in Alaska spans about 195,000 acres and is fully owned by EEENF in NPR-A. The site was recently acquired via the arket takeover of XCD Energy Ltd. Large prospects on trend to recently discovered fields; US$10m farm-out completed post XCD acquisition; Drilling to commence March 2021.

The Cascade Project covers 15,312 acres and contains historic oil discoveries and is near commissioned infrastructure. Called the Yukon oil leases this project was initially acquired due to its excellent location and low cost, especially considering 3D seismic trials revealed about 86 million barrels of resources in 2018.

88E recently reported that Rig 111 commenced drilling. The Merlin-1 well will initially be drilled to 1,500 feet, then surface casing will be installed, and the Blow Out Preventer System tested. the well will be deepened through the target horizons in the Nanushuk Formation to a maximum total depth of 6,000 feet. The Merlin-1 well is targeting 645 million barrels of gross mean prospective resource. According to management the Company has a war chest of US$13 million which will easily fund its share of the drilling of Merlin-1 and the company’s other planned activities. 88 Energy managing director Dave Wall stated, “Drilling has now commenced at Merlin-1, with results expected within the next 4 weeks. This is an exciting and pivotal time for the company and our shareholders.” The timing of a potential oil strike couldn’t be better with the Crude Oil WTI Index hitting a high of US$67.98 per barrel just last week, a level it hasn’t traded at since 2018.

Agree! $eeenf https://t.co/dKrp1hhO66

— Steve n Stocks (@StevenStocks5) June 26, 2021

$EEENF Capital Structure updated May 21st & Compared to Feb 23rd

David Wall DOUBLED his position since his departure (120M to 240M)

ML, Citibank, BNP, JPM: This is HIGH NETWORTH buying. Not Joe Shmoe's like you and me

Top 20 went from 36% of OS to 64% of OS.

Follow the money. pic.twitter.com/ecPCTXoOtM

— PokeStonks (@PokeStonks_) June 20, 2021

To Find out the inside Scoop on 88E Subscribe to Microcapdaily.com Right Now by entering your Email in the box below

On June 23 88 Energy updated shareholders on its operations on the North Slope of Alaska. Highlights include Geochemical analysis of fluid extracts from selected core samples definitively demonstrates the presence of hydrocarbons, Further quantitative screening on remaining samples to commence, Phase two of side-wall core trim analysis to commence shortly, including: quantitative extraction, SARA, isotopes and biomarker analysis Details.

88 Energy has recently received initial results from 5 of the 18 specifically selected trims from the side wall cores, with 2 of the 5 confirming the presence of hydrocarbons. Significantly, these depths were among the prospective zones that were not able to be tested with the RDT downhole fluid extraction tool. These zones also correspond with depths where good oil shows were noted during drilling, including petroliferous odour, fluorescence and cut. Small trims were cut from the side of several of the 48 side wall cores to undergo special analysis. The remaining material is reserved for routine core analysis.

These gas chromatography charts show a spread of carbon compounds with lighter molecules on the left and heavier components on the right. Oil signatures may be inferred by the presence of heavier carbon compounds seen in the two of the five samples run to date (as seen in Fig. 2). Importantl these signatures show no evidence of biodegradation.

The highly encouraging test results to date serve to refine the Company’s understanding of both the quantity and the mobility of hydrocarbons in place as well as the commercial potential of the greater Project Peregrine acreage, which will be further appraised in coming seasons. The Company looks forward to further results from the remaining 13 trims over the coming weeks. Phase two of the geochemical analysis program on the side-wall core trims will commence after completion of the analysis of remaining 13 trims, which will include quantitative extraction, SARA, isotopes and biomarkers analysis. These analyses are designed to confirm not only the presence of oil but also the nature of the source rock, enhancing understanding of the likely quality of the oil as well as migration pathways, which is critical for understanding regional implications on prospectivity across Project Peregrine.

In addition, the Company is looking forward to the preliminary results of the Volatiles Analysis Service (VAS), which is currently underway, as well as analysis of gases collected in isotubes while drilling. VAS and gas analysis further enhances knowledge of the depths at which oil accumulations may occur across the project area as well as wettability of the reservoir rocks. Testing Program and Status. The Company is highly encouraged by the preliminary results received to date from the Merlin-1 testing program, with analysis and interpretation of results ongoing. Once complete, these will be consolidated and integrated into the Project Peregrine database, which will form the basis of future farm-out and exploration on the acreage.

Pursuant to the requirements of the ASX Listing Rules Chapter 5 and the AIM Rules for Companies, the technical information and resource reporting contained in this announcement was prepared by, or v under the supervision of, Dr Stephen Staley, who is a Non-Executive Director of the Company. Dr Staley has more than 35 years’ experience in the petroleum industry

https://twitter.com/lucidleek1/status/1409647039810441216

For more on EEENF Subscribe Right Now!

88 Energy Ltd (OTCMKTS: EEENF) continues to move steadily higher over its $0.02 base with power in recent days as volume picks up heavily. EEENF is emerging as an investors favorite and is currently among the most actively searched and talked about stocks in small caps. Currently under heavy accumulation EEENF is moving steadily northbound with many new investors buying in every day. EEENF is looking to blaze a path along the likes of Enzolytics or Tesoro and break out into a whole new dimension – Tesoro went to multi dollars – EEENF is looking to take out $0.085 recent highs for confirmation of the next leg up and blue sky breakout! 88 Energy is a big story developing in smalll caps; The recent acquisition of XCD Energy gives the Company over 400,000 acres in the world class North Slope of Alaska estimated by the USGS in 2005 to hold more than 50 billion bbl of oil and a war chest of $13 million in the treasury. Timing could not be better for a potential mammoth oil strike with the Crude Oil WTI Index continuing to rise. 88 Energy recently commenced drilling the Merlin-1 well which will initially be drilled to 1,500 feet, then surface casing will be installed, and the Blow Out Preventer System tested. the well will be deepened through the target horizons in the Nanushuk Formation to a maximum total depth of 6,000 feet. 88 Energy has recently received initial results from 5 of the 18 specifically selected trims from the side wall cores, with 2 of the 5 confirming the presence of hydrocarbons. Significantly, these depths were among the prospective zones that were not able to be tested with the RDT downhole fluid extraction tool. These zones also correspond with depths where good oil shows were noted during drilling, including petroliferous odour, fluorescence and cut. Small trims were cut from the side of several of the 48 side wall cores to undergo special analysis. The remaining material is reserved for routine core analysis. Microcapdaily first reported on EEENF on March 18 when the stock was $0.015. We will be updating on 88E when more details emerge so make sure you are subscribed to Microcapdaily so you know what’s going on with 88E.

Subscribe to Our 100% Free Penny Stock Newsletter. We Have Something Big Coming!

Disclosure: we hold no position in 88E either long or short and we have not been compensated for this article

You may like

Featured

Sonoma Pharmaceuticals (NASDAQ: SNOA): Potential Surge to Speculations – What Lies Ahead?

Published

7 months agoon

January 10, 2024

Sonoma Pharmaceuticals (NASDAQ: SNOA) has been navigating through unpredictable market fluctuations lately, experiencing a noteworthy surge of approximately 32% today on January 10th, 2024. Although this might seem modest when juxtaposed with our other coverage & articles, our interest in SNOA lies in its promising trajectory and the speculations circulating among online users.

In the realm of biopharmaceuticals, SNOA finds itself amidst a pool of undervalued companies grappling with the challenging landscape of venture market conditions given the current cost of capital for companies that are pre-profitability. Since its funding round on October 18, the stock has witnessed a staggering 80% decline, settling at what appears to be rock bottom levels.

The critical question looming is whether there is untapped potential from the current levels. According to insights gathered from online discussions, the consensus is optimistic. But before we delve into the specifics, let’s establish some foundational background information.

Background:

SNOA is a key player in the global healthcare scene, specializing in the development and production of stabilized hypochlorous acid (HOCl) products. These versatile products find applications in various healthcare areas, such as wound care, eye care, oral and nasal care, dermatology, podiatry, animal health, and as non-toxic disinfectants.

What sets Sonoma’s products apart is their ability to tackle infections, alleviate itch and pain, reduce scarring, and counter harmful inflammatory responses in a safe and effective manner. Extensive in vitro and clinical studies of HOCl have underscored its impressive properties, including being antipruritic, antimicrobial, antiviral, and anti-inflammatory.

The magic of Sonoma’s stabilized HOCl lies in its immediate relief of itch and pain, pathogen-killing prowess, biofilm breakdown ability, all without causing any stinging or irritation to the skin. Additionally, it aids the natural healing process by oxygenating the cells in the treated area.

Sonoma’s products have made their mark in 55 countries worldwide, either through direct sales or partnerships, and the company actively seeks new distribution collaborators. Headquartered in Boulder, Colorado, Sonoma operates manufacturing facilities in Latin America, while its European marketing and sales hub is located in Roermond, Netherlands.

Breakdown On The Technology:

Let’s talk about their Microcyn® Technology, a stabilized triple-action topical technology.

Multifaceted benefits…

- Powerful Anti-Microbial: Effectively diminishes microbial load, demonstrating prowess in biofilm destruction.

- Anti-Inflammatory Agent: Exhibits anti-inflammatory properties, providing relief from itch and pain.

- Anti-Pruritic Activity: Proven effectiveness in alleviating itching, enhancing overall comfort.

- Tissue Healing: Stimulates increased blood and oxygen flow to wounds, fostering a conducive environment for tissue recovery.

Safety profile…

- No Drug Interactions or Contraindications: Demonstrates compatibility without risking complications arising from drug interactions.

- Proven Safety: With millions of patients treated globally, there hasn’t been a single report of a serious adverse effect.

- Rigorous Clinical Trials: Backed by 30+ human clinical trials involving over 1,500 patients, providing a robust foundation of evidence.

Product Efficacy…

- No Mutations or Resistance: In contrast to overused antibiotics that may lead to dangerous epidemics like MRSA, this solution offers a sustainable alternative.

Not just groundbreaking in its effectiveness, this product also stands as a cost-effective solution: - Preventative Measures: Reduces the need for frequent hospital or physician visits, proving valuable in a preventative capacity.

- Savings for Medicare/Hospitals: Accelerates healing, subsequently reducing hospital stays and presenting a practical avenue for cost savings.

Subscribe to Microcapdaily.com Right Now by entering your Email in the box below.

Subscribe to Our 100% Free Penny Stock Newsletter. We Have Something Big Coming!

Latest Press Release:

NovaBay Pharmaceuticals, Inc. (NYSE: NBY) and SNOA entered into an agreement for the sale and marketing of Avenova®-branded products by Sonoma in the European Union. The collaboration involves combining Sonoma’s existing eye product, Ocudox®, which has received approval for sale in the European Union, with the Avenova brand. These products will be marketed through Sonoma’s established European distribution network.

Sonoma will manufacture Ocudox by Avenova with packaging similar to NovaBay’s Avenova products, recognized as the leading hypochlorous acid-based eye care items in the United States. Sonoma will pay NovaBay a royalty fee based on the sales of Ocudox by Avenova. Importantly, Sonoma will continue marketing its Ocudox product independently in the European Union.

The partnership is seen as an opportunity for both companies to leverage their strengths. Sonoma, with its strong presence in the European Union, aims to expand its eye care offerings by adding Avenova-branded products. NovaBay anticipates the European market to be comparable in size to the U.S., providing an opportunity to double its sales of Avenova. NovaBay will maintain exclusivity in selling Avenova-branded products in the U.S.

So What:

Typically investors are left to their own accord to decipher the importance of a release, here’s a further breakdown as to why this partnership is beneficial for SNOA:

- European Expansion: Sonoma can now broaden its eye care offerings in the EU with the addition of Avenova-branded products, diversifying its portfolio.

- Strategic Combo: Merging Sonoma’s Ocudox® with Avenova branding combines Sonoma’s global distribution expertise with Avenova’s established name, creating a unique product for the European market.

- Financial Boost: Producing Ocudox by Avenova generates a royalty fee for Sonoma, enhancing its financial stability.

- Smart Positioning: The collaboration strategically leverages Sonoma’s EU presence and Avenova’s U.S. dry eye market recognition, strengthening Sonoma’s competitive position.

- Blepharitis Solution: Sonoma’s CE-marked Ocudox by Avenova addresses blepharitis, offering a valuable solution for a prevalent eye health issue in Europe.

- Market Growth: Recognizing the EU’s market size comparable to the U.S. signals significant growth potential for Sonoma, aligning with its goal to expand its eye care offerings.

Market Cap vs. Cash Position:

As it stands, SNOA’s current market capitalization hovers around $2.8 million, closely mirroring its $2.9 million cash position on the balance sheet. This doesn’t mark the most substantial market cap to cash comparison on record, it’s not entirely unprecedented to witness companies trading with cash holdings two or even three times their market cap. But nonetheless, this observation is still important. In the scenario of a complete business sell-off, the cash reserves alone would surpass the company’s entire valuation.

This calculation wouldn’t even account for their assets or potential future cash flows of products. The company has 21 FDA clearances for its medical devices, got CE marks for over 39 products, and has the green light from regulators worldwide. All of this is packed into a market cap of just $2.8 million…

Low Float:

Adding to the intrigue surrounding SNOA is its remarkably low float, standing at just 13.43 million shares. As many of you are likely aware, the float represents the shares available for trading in the open market, and this can potentially bode well for a public company. Here’s why:

- Price Volatility: With a low float, there is the potential for increased price volatility. Limited supply and heightened demand can lead to more significant price swings, which can attract short-term traders and investors seeking quick returns.

- Responsive to News: Public companies with a low float tend to be more responsive to positive news or strong financial results. The limited number of shares available can result in a quicker and more pronounced market reaction, potentially driving the stock price higher.

- Strategic Control: A low float provides management and major stakeholders with more strategic control over the company’s direction. It becomes easier to influence stock movements, attract investor attention, and implement changes in response to market dynamics.

- Potential for Rapid Appreciation: In certain situations, a low float can contribute to rapid stock appreciation. Increased demand, whether due to positive developments or investor sentiment, can result in a quicker uptrend in share prices.

- Takeover Attractiveness: Companies with a low float may be perceived as more attractive acquisition targets. A potential acquirer may find it easier to accumulate a significant stake in the company, leading to increased buyout interest and potentially higher acquisition premiums.

Subscribe to Microcapdaily.com Right Now by entering your Email in the box below.

Subscribe to Our 100% Free Penny Stock Newsletter. We Have Something Big Coming!

Short Squeeze Potential:

We couldn’t help but take notice of the substantial off-exchange short interest, currently standing at around 53%.

Off-exchange short interest refers to the level of short positions held by traders or institutions that are executed outside of the traditional exchanges. These trades often take place in dark pools, which are private forums for trading securities away from public scrutiny.

The reported dark pool short interest may not perfectly capture the entire market sentiment, but it’s an important factor to keep on your radar. In the world of investments, a high dark pool short interest is definitely worth noting, and SNOA’s is fairly high.

Now, consider the scenario of a potential short squeeze. Could SNOA opt for additional dilution to raise funds at a higher valuation if one occurs?

Maybe, but according to insights from @MoonMarket_, it seems unlikely. In February 2023, SNOA had an ATM open for $420,838, but the remaining capacity is now $0, implying that the company is less likely to exert downward pressure on the share price.

On top of this, it’s worth highlighting that SNOA boasts enough cash runway to last another year, suggesting that they might not be in a hurry to dilute investors.

Conclusion:

In the grand scheme, SNOA’s current valuation presents an intriguing mix of indicators, with some financial influencers on X also signaling at potential near-term appreciation. However it’s crucial to exercise caution, considering the online landscape is peppered with traders who may not always be on the mark—just as even top research analysts can make mistakes. Nevertheless, the multitude of factors at play makes SNOA a particularly interesting stock. As is customary with such companies, developments unfold swiftly, so be sure to maintain a vigilant watch.

We will update you on SNOA when more details emerge, subscribe to Microcapdaily to follow along!

Subscribe to Our 100% Free Penny Stock Newsletter. We Have Something Big Coming!

Disclosure: We have not been compensated for this article/video. MicroCap Daily is not an investment advisor; this article/video does not provide investment advice. Always do your research, make your own investment decisions, or consult with your nearest financial advisor. This article/video is not a solicitation or recommendation to buy, sell, or hold securities. This article/video is our opinion, is meant for informational and educational purposes only, and does not provide investment advice. Past performance is not indicative of future performance.

Picture by StockSnap from Pixabay.com

Featured

1847 Holdings (NYSE: EFSH) Soars: Insights, Acquisitions, and What Lies Ahead

Published

7 months agoon

January 8, 2024

1847 Holdings LLC (NYSE: EFSH) has been on fire the past two trading sessions. Amidst these volatile sessions came explosive gains, peaking at over 60%. Additionally, there has been significant traction from retail investors who appear to be jumping in after exciting announcements. Could EFSH be worth keeping an eye on for the long haul or, at the very least, hold value as a momentum trade? Let’s find out. We’ll begin by examining the company’s background, exploring recent developments, and understanding their significance as the company progresses into 2024.

Background:

1847 Holdings is focused on acquiring private, lower-middle market businesses. It was founded by Ellery W. Roberts, who brings with him 20 years of private equity experience from Parallel Investment Partners, Saunders Karp & Megrue, and Lazard Freres Strategic.

Before we dive into EFSH, it’s worth noting that Roberts has directly overseen more than $3.0 billion in private equity investments throughout his career. This speaks volumes about his expertise and track record in the field.

The company’s core idea is pretty straightforward: they believe that many small or lower-middle market businesses, despite having strong intrinsic value, often face limited options for an exit or moving forward due to certain inefficiencies in the capital market. Capitalizing on this, 1847 Holdings consistently acquires businesses it considers “solid” at reasonable prices relative to their cash flow. Once acquired, they concentrate on strengthening these businesses by enhancing their infrastructure and systems to bolster operations.

These improvements may lead to a sale or IPO of an operating subsidiary at higher valuations than the purchase price and/or alternatively, an operating subsidiary may be held in perpetuity and contribute to 1847 Holdings’ ability to pay regular and special dividends to shareholders.

Subscribe to Microcapdaily.com Right Now by entering your Email in the box below.

Subscribe to Our 100% Free Penny Stock Newsletter. We Have Something Big Coming!

Acquisitions:

EFSH has completed a total of six acquisitions so far. Here’s a quick breakdown of each acquisition to enhance your understanding of their overall value proposition.

Asien’s Appliance:

Based in Santa Rosa, CA, Asien’s holds a strong reputation as one of the oldest and most respected appliance retailers in the San Francisco Bay Area. With 1847 Holdings’ team boasting significant expertise from successful ventures like Hatworld/Lids, Teavana (acquired by Starbucks in 2012), and Regional Management Corporation, Asien’s becomes a sturdy platform for growth. 1847 anticipates expanding its market reach and establishing a more influential presence in the local area leveraging Asien’s strong foundation.

Kyle’s Custom Wood Shop:

Based in Boise, ID, the company has witnessed a surge in housing demand spurred by people moving into Idaho from other states.

Idaho experienced 2.1% population growth in 2019, surpassing all other states, and the Boise Metro Area ranked eighth among the fastest-growing metros in the US, witnessing a 2.8% population uptick. The influx is largely driven by retirees and older professionals attracted to lower home prices, shorter commutes, fewer natural disasters, and reduced taxes. Notably, most newcomers to Idaho earn incomes higher than the state average.

To meet this rising demand, 1847 Holdings plans to increase its capacity by collaborating with more builders, bidding on new projects, and investing in facilities and staff. They aim to fuel growth by broadening their product range and sales avenues, including multifamily housing, remodeling, and DIY segments.

WOLO Manufacturing:

WOLO Manufacturing specializes in top-notch horn technology (electric, air, truck, marine, electronic specialty, air & back-up alarms) and vehicle emergency warning lights. They’re known for providing the best quality and widest range of products for cars, trucks, and industrial equipment. With over 45 years in the automotive aftermarket, Wolo has been a reliable supplier of innovative automotive products, including horns, emergency warning lights, security, and lighting solutions.

High Mountain Door & Trim: no website but good reviews

High Mountain stands as the go-to source for window, door, hardware, millwork, and various standard carpentry essentials. There does not appear to be an active website, but the customer reviews are quite positive, with a 4.9/5 rating. According to EFSH, they have a curated selection of premium product that require customer inquiry for a personalized quote that fulfills building needs. To be candid, this particular vertical appears relatively insignificant in contributing value to EFSH’s acquisitions due to its small size. But a more precise assessment will emerge once we take a look at the latest earnings.

Innovative Cabinets & Design:

Innovative Cabinets & Design is another locally owned custom cabinetry subsidiary of EFSH, but situated in Reno, NV. This small business is renowned for its exceptional craftsmanship, dedicated customer service, and exquisite outcomes in both businesses & homes across northern Nevada. Their mission is centered on delivering top-tier cabinets, countertops, and bespoke design solutions tailored to meet the unique requirements of each space they serve.

ICU Eyewear Holdings:

ICU Eyewear Holdings has been around for nearly 70 years and is headquartered in Hollister, California. Their line of business is in the realm of reading eyewear, sunglasses, and personal healthcare items. Boasting a portfolio of 10 brands, ICU offers an expansive and innovative array of over 3,000 SKUs across reading glasses, sunglasses, and health & personal care products. With a customer base spanning national, regional, and specialty retailers, totaling more than 7,500 retail locations, ICU holds a unique position as the sole OTC eyewear supplier in the U.S. to significantly penetrate diverse retail channels including grocery, specialty, office supply, pharmacy, and outdoor sports stores.

Earnings:

Before we dive into the numbers of the last earnings, let’s take a moment to hear what the CEO, Elley Roberts, had to say.

“I am pleased to report that revenues for the third quarter of 2023 increased by 29.8% and our gross profit increased 64.9% over the same period last year. We attribute this performance to the strength of our platform and our ability to support the growth of our portfolio companies, while at the same time improving their profitability. During the quarter, we successfully restructured convertible notes to eliminate the potential equity dilution, and recently Egan-Jones affirmed their BB+ rating on our senior credit facility, which further illustrates the strength of our balance sheet. Importantly, our cash flow continues to improve and based on our current trajectory, we expect to achieve over 50% revenue growth in 2023. Heading into 2024, we expect to continue our strong revenue growth, which should significantly enhance our profitability as we leverage our fixed costs and benefit from economies of scale. We also believe that the intrinsic value of the business has not been recognized by the public market, and, as a result, we continue to explore a variety of strategic options which could include spinoffs of subsidiaries or privatization of the Company to maximize value for our shareholders.”

Q3 2023 Financial Highlights:

Total Revenues: $18,777,921 for three months ended September 30, 2023 vs. $14,472,361 in 2022.

Breakdown By Segments:

- Retail & Appliances: $2,421,008 (decrease of 17.5% from $2,934,705 in 2022)

- Retail & Eyewear: $4,243,254

- Construction: $11,230,579 (increase of 11.8% from $10,047,946 in 2022)

- Automotive Supplies: $883,080 (decrease of 40.7% from $1,489,710 in 2022)

Total Cost of Revenues: $10,737,174 for three months ended September 30, 2023 vs. $9,596,387 in 2022

Breakdown by Segments:

- Retail & Appliances: $1,976,031 (decrease of 9.5% from $2,183,972 in 2022)

- Retail & Eyewear: $2,662,586 (62.7% of retail and eyewear revenues)

- Construction: $5,472,716 (decrease of 16.4% from $6,544,843 in 2022)

- Automotive Supplies: $625,841 (decrease of 27.9% from $867,572 in 2022)

The total net loss from continuing operations was $5,859,072 vs. $4,472,622 in 2022. It’s important to note that the reason behind this is due to an interest expense of $5,074,169 and “other expense” of $187,200. Excluding these expenses, the net loss would have been $597,703 for 2023, a significant improvement from $4,472,622 in 2022.

So What:

While not guaranteed, sustained progress along this trajectory might signal imminent profitability. Considering the company’s substantial $49 million revenue in 2022, a valuation of $2.2 million appears quite undervalued. This likely stems from prevailing market conditions and the high cost of capital. The constrained funding available for unprofitable companies has resulted in drastically reduced valuations across the board, possibly also impacting EFSH’s valuation.

Subscribe to Microcapdaily.com Right Now by entering your Email in the box below.

Subscribe to Our 100% Free Penny Stock Newsletter. We Have Something Big Coming!

What Happened:

EFSH planned for a 1-for-4 reverse split of its common shares which was effective today, January 8, 2024. This move aimed to decrease their outstanding shares from approximately 3.43 million to about 860K and reduced the float to 850K shares. The CEO Ellery W. Roberts believes this restructuring will enhance investor appeal and better position the company for future acquisitions.

As many of you may be aware, a reverse split isn’t often seen as advantageous for a company. Depending on the rationale behind its implementation, it might appear as though the company failed to fulfill its commitments to investors, diminishing interest in the stock and causing its value to decline until it risks non-compliance with the respective exchange regulations.

However, looking at the other side of the coin, an 850K float can make EFSH highly volatile. This volatility can potentially yield substantial gains in a single day due to the limited number of shares available for trading in the market. Retail investors frequently seek out companies in such situations, anticipating near-term events that could trigger a significant upturn, or even prompt a short squeeze.

As for EFSH, many investors kept the company on their radar for today’s effective date of the reverse split.

Conclusion:

In closing, EFSH’s recent surge raises an important question, does it have further room to grow? Well at the very least, the intrinsic value appears much higher than what the market is offering. Judging by the latest release, Roberts’ is even entertaining the prospect of taking the company private due to the unforgiving nature of the public market.

If that doesn’t happen, the company’s strategic acquisitions, revenue expansion, and positive trajectory in profitability hints of promising opportunities ahead. Even with the recent surge, the market cap is still extremely low compared to sales revenue.

With a mere 850K float, any acquisition in the pipeline could trigger substantial market reactions. As EFSH navigates market dynamics and leverages its portfolio, many investors are closely monitoring its potential for both momentum and long-term trades. We suggest you do the same is developments continue to evolve.

We will update you on EFSH when more details emerge, subscribe to Microcapdaily to follow along!

Subscribe to Our 100% Free Penny Stock Newsletter. We Have Something Big Coming!

Disclosure: We have not been compensated for this article/video. MicroCap Daily is not an investment advisor; this article/video does not provide investment advice. Always do your research, make your own investment decisions, or consult with your nearest financial advisor. This article/video is not a solicitation or recommendation to buy, sell, or hold securities. This article/video is our opinion, is meant for informational and educational purposes only, and does not provide investment advice. Past performance is not indicative of future performance.

Picture by RonaldCandonga from Pixabay

Featured

Rainmaker Worldwide (OTC: RAKR): Exploring Recent Fluctuations & Strategic Acquisition

Published

7 months agoon

January 4, 2024

Rainmaker Worldwide (OTC: RAKR) has experienced significant fluctuations in recent months, with occasional increases of over 400% within days. From trading around $0.0007 per share in late September, RAKR recently reached peaks of $0.0035, hitting its highest point since February last year. Today, we’ll dive into a significant event that unfolded and explore the reasons behind the high expectations. We’ll start with their generic background to better understand the company and what’s in store for 2024.

Background:

RAKR, based in Peterborough, ON, Canada, stands as a global leader in the Water Technology sector. The company specializes in delivering its cutting-edge Technology through a Water-as-a-Service model, directly supplying its products to clients and distributors worldwide. A significant portion of Rainmaker’s operations lies in its 12% ownership of Rainmaker Holland B.V., an innovative manufacturing centre situated in Rotterdam, Netherlands.

They deploy two energy-efficient technologies aimed at providing fresh water to communities and corporations in need. The first, Air-to-Water technology, extracts fresh water from atmospheric humidity and heat. The second, Water-to-Water technology, converts seawater or contaminated water into safe drinking water or commercial-grade input water. These technologies are powered by renewable energy sources like wind, solar, and electric grid, leaving negligible carbon footprints.

Rainmaker’s solutions are highly versatile, scalable, and environmentally conscious. Their Air-to-Water units start at a rated capacity of 5,000L of drinking water and can be expanded based on requirements, with actual output contingent on deployed climatic conditions. Similarly, Water-to-Water units come in various configurations, ranging from 37,500L to 150,000L.

Their story and mission is simple, create safe drinking water in areas where access to such resources is limited or absent.

8-K Filing (Significant Update):

On December 19th, 2023, RAKR extended their agreement to buy Miranda Water Treatment Systems, (MWTS) an internationally recognized leader in biological water, wastewater treatment and water reuse systems.

MWTS, based in Ankara, Turkey, represents a substantial addition to RAKR, enabling the utilization of wastewater treatment systems distributed and supported by a worldwide network of dealers, installers, and distributors.

According to the release, “MWTS delivers a complementary suite of products and services to RAKR’s Air-to-Water (“AW”) and Water-to-Water technologies (“WW”), with an installed base spanning 31 countries that are harmonious with RAKR’s footprint. Its state-of-the-art technology focuses on wastewater treatment systems for communities of up to 30,000 people as well as post-treatment systems and alternative techniques to manage septic tank needs for communities, hospitals, hotels, and more.”

The initial MOU was signed in 2022, but the extension allows them more time to plan a trip to Turkey for the final signing on January 22, 2024. Yes, you read that correctly – January 22, 2024. It’s only a matter of weeks away until the documents are signed in person to complete the share transfer.

Agreement details:

The Company will buy Miranda for $5 million, divided into three payments.

- Payments of US$2M and US$1M will be made through issuing 40,000,000 RAKR shares valued at $0.05 per share

- A second payment of US$1M will happen 18 months after the first payment.

- A third payment of US$1M will be made 24 months after the first payment.

- Both the second and third payments will have 12% interest each year.

- RAKR has an option to pay these amounts either partially or in full prior, to the closing dates

Here’s where it gets more interesting….

Subscribe to Microcapdaily.com Right Now by entering your Email in the box below.

Subscribe to Our 100% Free Penny Stock Newsletter. We Have Something Big Coming!

So What:

RAKR definitely had an interesting 8-K filing, but for those who aren’t familiar with why this matters in the first place, let’s break it down:

- Investor Confidence: Issuing shares at a higher value per share might signal confidence in the future prospects of RAKR. The acquisition values RAKR at $0.05 per share, that’s over a 1500% gain from today’s closing of $0.003 per share. This could also be seen as a strategic move to secure an acquisition while projecting positive growth expectations.

- Facilitating Acquisition: The issuance of shares valued at $0.05 per share allows the Company to acquire Miranda for an aggregate consideration of $5 million. Their method involved favourable terms and facilitates an acquisition without using excessive cash reserves, thus conserving liquidity for other operations or investments.

- Strategic Acquisition: Acquiring Miranda brings in significant value or strategic advantage to RAKR. The addition of Miranda’s technology, resources, or market access could potentially bolster RAKR’s business offerings or market position, justifying the premium attached to the share issuance.

- Flexible Payment Structure: The structured payment plan with multiple closings allows the Company to stagger the payments over time. This flexibility might provide financial relief and help manage cash flows more effectively.

- Interest Accrual and Prepayment Option: While the deferred payments accrue interest at an annual rate of 12%, the Company retains the discretion to prepay these amounts before the scheduled closing dates, mitigating the overall interest costs associated with the acquisition.

Conclusion:

This is far from an exhaustive due diligence, but we believe RAKR’s 8-K filing alone adds a layer of intrigue to the company. It highlights a potential near-term catalyst that could swiftly alter the company’s trajectory. As the company gears up for the signing on January 22, 2024, there’s potential for increased investor interest in light of the current valuation. This interest could be driven by the fact that the raise was valued at over a 1500% premium. We’ll be sure to keep you informed as events unfold, but we strongly recommending you keep RAKR on your radar.

We will update you on RAKR when more details emerge, subscribe to Microcapdaily to follow along!

Subscribe to Our 100% Free Penny Stock Newsletter. We Have Something Big Coming!

Disclosure: We have not been compensated for this article/video. MicroCap Daily is not an investment advisor; this article/video does not provide investment advice. Always do your research, make your own investment decisions, or consult with your nearest financial advisor. This article/video is not a solicitation or recommendation to buy, sell, or hold securities. This article/video is our opinion, is meant for informational and educational purposes only, and does not provide investment advice. Past performance is not indicative of future performance.

Recent Posts

Clean Vision Corp (OTC: CLNV): Overcoming the Plastic Waste Crisis

Meta Materials (NASDAQ: MMAT): More Due Diligence and Exploring Latest Developments

Integrated Cannabis Solutions’ (OTC: IGPK) 633% Surge: Exploring Catalysts, Company Overview, and Growth Potential in 2024

Sonoma Pharmaceuticals (NASDAQ: SNOA): Potential Surge to Speculations – What Lies Ahead?

1847 Holdings (NYSE: EFSH) Soars: Insights, Acquisitions, and What Lies Ahead

Trending

-

Uncategorized2 years ago

Uncategorized2 years agoMeta Materials Inc (OTCMKTS: MMTLP) Enormous Short Position in Trouble as Next Bridge Hydrocarbons Set to Stop Trading (George Palikaras & John Brda on Corporate Action)

-

Micro Cap Insider3 years ago

Micro Cap Insider3 years agoMedium (KOK PLAY) The Parabolic Rise of Metal Arts (OTCMKTS: MTRT)

-

Media & Technology3 years ago

Media & Technology3 years agoHealthier Choices Management Corp. (OTCMKTS: HCMC) Powerful Comeback Brewing as PMI Patent Infringement Lawsuit Moves Forward

-

Media & Technology4 years ago

AMECA Mining RM; the Rise of Southcorp Capital, Inc. (OTCMKTS: STHC)

-

Media & Technology3 years ago

Media & Technology3 years agoSNPW (Sun Pacific Holding Corp) Power Brewing: 50MW solar farm project in Durango Mexico MOU with Atlas Medrecycler 48,000 SF New Partnership Queensland Australia Solar Farm.

-

BioPharma2 years ago

BioPharma2 years agoAsia Broadband (OTCMKTS: AABB) On the Move Northbound Since Sub $0.08 Dip as Crypto Innovator Elevates AABB Crypto Exchange & Enters the NFT Space

-

Uncategorized2 years ago

Uncategorized2 years agoMeta Materials Inc (OTCMKTS: MMTLP) Short Squeeze S-1a4 Filing Signals S1 Approval Could Be Days Away (Next Bridge Hydrocarbons Spin-Off)

-

BioPharma3 years ago

BioPharma3 years agoHumbl Inc (OTCMKTS: HMBL) Major Reversal as Powerful Advisor Rejoins the Team & Looks to Uplist to Major Exchange