Micro Cap Insider

Swift Rise of Biotech IPIX (Innovation Pharmaceuticals) as Potent Therapeutic Brilacidin Begins Clinical Trials

Published

3 years agoon

By

Boe Rimes

IPIX (Innovation Pharmaceuticals) is making a major run up the charts in recent weeks making a move towards its June highs of $0.65 per share on fast growing volume topping several million in dollar volume per day. IPIX has been under heavy accumulation recently and volume has picked up substantially since early December as a new era of penny stock speculators fueled by the robinhood app and its brand new 100 million trading accounts take on the bulletin boards. These are different times than just a few short years ago; now penny stocks such as TSNP can achieve a $6 billion plus market valuation and trade $375 million in dollar volume in a day on the bulletin boards. And TSNP has no stronger fundamentals than IPIX does. IPIX has a long history of legendary runs skyrocketing to $4.93 per share when it was trading as CTIX. Currently making a move on its recent highs, investors are looking for a break over $0.65 for confirmation of the next big leg up.

It’s easy to get excited about IPIX; the Company’s flagship Brilacidin is quickly emerging as a unique 3-in-1 combination—antiviral, immuno/anti-inflammatory, and antimicrobial—COVID-19 therapeutic candidate, with pan-coronavirus treatment potential. Brilacidin, which has received FDA Fast Track designation for the potential treatment of COVID-19, is one of the few drugs targeting COVID-19 that has been tested in human trials for other clinical indications, providing established safety and efficacy data. Pre-clinical testing at independent laboratories supports Brilacidin’s antiviral ability to safely and potently inhibit SARS-CoV-2, and multiple strains of human coronaviruses (H-CoVs). Earlier this month IPIX began its Phase 2 clinical trial of Brilacidin for treating COVID-19. The Phase 2 randomized, placebo-controlled clinical trial includes approximately 120 hospitalized patients with moderate-to-severe COVID-19. Two intravenous treatment arms were enrolled—active and placebo, with ~60 patients per arm. The trial’s primary endpoint is time to sustained recovery through Day 29 based on the National Institute of Allergy and Infectious Diseases (NIAID) Adaptive COVID-19 Treatment Trial (ACTT) clinical status ordinal scale. A non-peer-reviewed study recently reported that Brilacidin Exhibits Potent In Vitro Antiviral Activity Against SARS-CoV-2. A peer-reviewed study recently published reported that Brilacidin Exhibits Potent In Vitro Antiviral Activity Against SARS-CoV-2.

Innovation Pharmaceuticals (OTCQB: IPIX) is a clinical stage biopharmaceutical company developing a world-class portfolio of innovative therapies addressing multiple areas of unmet medical need, including inflammatory diseases, cancer, infectious diseases, and dermatologic diseases. Brilacidin, a versatile compound with broad therapeutic potential, is in a new chemical class called defensin-mimetics. A Phase 2 trial of Brilacidin as an oral rinse for the prevention of Severe Oral Mucositis (SOM) in patients with Head and Neck Cancer, met its primary and secondary endpoints, including reducing the incidence of SOM. The Company plans to advance Brilacidin oral rinse into Phase 3 development, subject to available financial resources. Positive results were also observed in a Phase 2 Proof-of-Concept trial treating patients locally with Brilacidin for Ulcerative Proctitis/Ulcerative Proctosigmoiditis (UP/UPS). Brilacidin for UP/UPS was licensed to Alfasigma S.p.A. in July 2019, who have recently initiated a Phase 1 study with their formulation. A Phase 2b trial of Brilacidin showed a single intravenous dose of the drug delivered comparable outcomes to a seven-day dosing regimen of the FDA-approved blockbuster daptomycin in treating Acute Bacterial Skin and Skin Structure Infection. Kevetrin is a novel anti-cancer drug shown to modulate p53, often referred to as the “Guardian Angel Gene” due to its crucial role in controlling cell mutations and has successfully completed a Phase 2 trial in Ovarian Cancer. Brilacidin, based on promising in vitro antiviral activity against SARS-CoV-2, is being evaluated as a potential treatment for COVID-19.

Innovation Pharmaceuticals (OTCQB: IPIX) is a clinical stage biopharmaceutical company developing a world-class portfolio of innovative therapies addressing multiple areas of unmet medical need, including inflammatory diseases, cancer, infectious diseases, and dermatologic diseases. Brilacidin, a versatile compound with broad therapeutic potential, is in a new chemical class called defensin-mimetics. A Phase 2 trial of Brilacidin as an oral rinse for the prevention of Severe Oral Mucositis (SOM) in patients with Head and Neck Cancer, met its primary and secondary endpoints, including reducing the incidence of SOM. The Company plans to advance Brilacidin oral rinse into Phase 3 development, subject to available financial resources. Positive results were also observed in a Phase 2 Proof-of-Concept trial treating patients locally with Brilacidin for Ulcerative Proctitis/Ulcerative Proctosigmoiditis (UP/UPS). Brilacidin for UP/UPS was licensed to Alfasigma S.p.A. in July 2019, who have recently initiated a Phase 1 study with their formulation. A Phase 2b trial of Brilacidin showed a single intravenous dose of the drug delivered comparable outcomes to a seven-day dosing regimen of the FDA-approved blockbuster daptomycin in treating Acute Bacterial Skin and Skin Structure Infection. Kevetrin is a novel anti-cancer drug shown to modulate p53, often referred to as the “Guardian Angel Gene” due to its crucial role in controlling cell mutations and has successfully completed a Phase 2 trial in Ovarian Cancer. Brilacidin, based on promising in vitro antiviral activity against SARS-CoV-2, is being evaluated as a potential treatment for COVID-19.

Brilacidin, which has received FDA Fast Track designation for the potential treatment of COVID-19, is one of the few drugs targeting COVID-19 that has been tested in human trials (a total of 8) for other clinical indications, providing established safety and efficacy data on over 460 subjects, thereby potentially enabling it to rapidly help address the novel coronavirus crisis. Pre-clinical testing at independent laboratories supports Brilacidin’s antiviral ability to safely and potently inhibit SARS-CoV-2, and multiple strains of human coronaviruses (H-CoVs). In a human lung cell line against SARS-CoV-2, Brilacidin achieved a Selectivity Index of 426. A molecular screening study of 11,552 compounds also supports Brilacidin as a promising novel coronavirus treatment. Brilacidin antiviral research to date has been limited to laboratory-based experiments. Additional pre-clinical and clinical data support Brilacidin’s inhibition of IL-6, IL-1β, TNF-α and other pro-inflammatory cytokines and chemokines, which have been identified as central drivers in the worsening prognoses of hospitalized COVID-19 patients. Brilacidin’s robust antimicrobial properties might also help to fight secondary bacterial infections, which can co-present in up to 20 percent of COVID-19 patients. Collectively, these data support Brilacidin as a unique 3-in-1 combination—antiviral, immuno/anti-inflammatory, and antimicrobial—COVID-19 therapeutic candidate, with pan-coronavirus treatment potential.

Microcapdaily has been covering IPIX for years starting with CTIX back in 2015 reporting on the stocks legendary run to $4.93 per share. We stated on CTIX back in the day: “As anyone in the industry knows, regulating the p53 pathway has long been the holy grail of cancer research and big pharma has spent hundreds of millions of dollars researching ways to achieve this with no success thus far. It seems Kevetrin(TM) has accomplished this; extensive preclinical research on Kevetrin shows the re-activation of p53 across a wide spectrum of cancer lines including colon, lung, breast and pancreatic cancers. The market potential for Kevetrin in treating drug-resistant cancers is worth $5 billion a year. Other cancers could easily represent an additional $5 billion annually, he adds.”

Investor sentiment in IPIX is high:

https://twitter.com/TopCincoSpaZz/status/1361901994680733697

I'm in on $IPIX the research looks awesome

— Kurt Marzolf (@MarzolfKurt) February 16, 2021

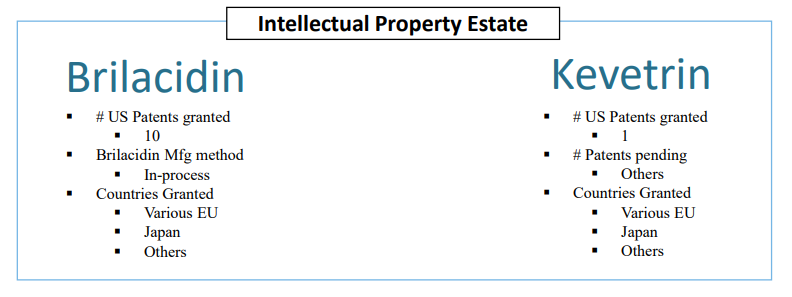

IPIX has established a valuable intellectual property portfolio:

To Find out the inside Scoop on IPIX Subscribe to Microcapdaily.com Right Now by entering your Email in the box below

Earlier this month IPIX began its Phase 2 clinical trial of Brilacidin for treating COVID-19. The Phase 2 randomized, placebo-controlled clinical trial includes approximately 120 hospitalized patients with moderate-to-severe COVID-19. Two intravenous treatment arms were enrolled—active and placebo, with ~60 patients per arm. The trial’s primary endpoint is time to sustained recovery through Day 29 based on the National Institute of Allergy and Infectious Diseases (NIAID) Adaptive COVID-19 Treatment Trial (ACTT) clinical status ordinal scale. Other endpoints include: in-hospital outcomes, all-cause mortality, measurement of inflammation-related biomarkers, changes to SARS-CoV-2 viral load, and other key measures. The Company believes Brilacidin holds tremendous promise to help address the global pandemic, particularly given the emergence of contagious and virulent coronavirus variants. Data increasingly are showing these variants can significantly lessen the effectiveness of COVID-19 treatments and vaccines. For example, a Phase 2b trial in South Africa showed the Novavax vaccine was less than 50 percent effective against a new coronavirus variant originally identified in that country.

A key differentiating aspect of Brilacidin’s antiviral mechanism of action is its ability to attack the coronavirus directly by disrupting viral membrane integrity. This suggests Brilacidin would be less prone to resistance developing due to viral mutations. Brilacidin already has been shown to inhibit the Washington and Italian strains of the coronavirus and multiple strains of endemic human coronaviruses (H-CoVs), with additional laboratory testing of Brilacidin planned against new coronavirus variants. Novel therapeutics with broad-spectrum anti-coronavirus properties are, and will continue to be, much-needed as the world confronts the coronavirus pandemic and prepares for the likelihood of future viral pandemics.

Recently after the FDA approved the Company’s Investigational New Drug (IND) application to proceed with initiation of a Phase 2 clinical trial of Brilacidin in hospitalized patients with COVID-19 the Company’s CEO Leo Ehrlich stated: “It’s clear from comments of infectious disease experts like Dr. Anthony Fauci and recent news reports on emerging COVID-19 variants that we are not out of the woods yet with the coronavirus, by any stretch of the imagination. Even with vaccines starting to be rolled-out, it is going to be many more months for them to reach the masses and potentially years before vaccines are available worldwide. There is now and will be into the foreseeable future a real need for new therapeutics to treat people who contract the infection. We have great hopes Brilacidin will emerge as a novel therapeutic to help fight the global pandemic.”

The scientific basis/signal that CCL5 was uninspiring as a potential COVID19 treatment option was established over 3 mo ago

There's no excuses, it's all there in plain writing

I think $IPIX's brilacidin has much more coronavirus therapeutic potential than CCL5's like leronlimab

— Archimedes (@AlphaTrader00) February 15, 2021

For More on IPIX Subscribe Right Now!

IPIX is making a major run up the charts in recent weeks making a move towards its June highs of $0.65 per share on fast growing volume topping several million in dollar volume per day. IPIX has been under heavy accumulation recently and volume has picked up substantially since early December as a new era of penny stock speculators fueled by the robinhood app and its brand new 100 million trading accounts take on the bulletin boards. These are different times than just a few short years ago; now penny stocks such as TSNP can achieve a $6 billion plus market valuation and trade $375 million in dollar volume in a day on the bulletin boards. And TSNP has no stronger fundamentals than IPIX does. IPIX has a long history of legendary runs skyrocketing to $4.93 per share when it was trading as CTIX. Currently making a move on its recent highs, investors are looking for a break over $0.65 for confirmation of the next big leg up. It’s easy to get excited about IPIX; the Company’s flagship Brilacidin is quickly emerging as a unique 3-in-1 combination—antiviral, immuno/anti-inflammatory, and antimicrobial—COVID-19 therapeutic candidate, with pan-coronavirus treatment potential. Brilacidin, which has received FDA Fast Track designation for the potential treatment of COVID-19, is one of the few drugs targeting COVID-19 that has been tested in human trials for other clinical indications, providing established safety and efficacy data. Pre-clinical testing at independent laboratories supports Brilacidin’s antiviral ability to safely and potently inhibit SARS-CoV-2, and multiple strains of human coronaviruses (H-CoVs). Earlier this month IPIX began its Phase 2 clinical trial of Brilacidin for treating COVID-19. The Phase 2 randomized, placebo-controlled clinical trial includes approximately 120 hospitalized patients with moderate-to-severe COVID-19. Two intravenous treatment arms were enrolled—active and placebo, with ~60 patients per arm. The trial’s primary endpoint is time to sustained recovery through Day 29 based on the National Institute of Allergy and Infectious Diseases (NIAID) Adaptive COVID-19 Treatment Trial (ACTT) clinical status ordinal scale. A peer-reviewed study recently published reported that Brilacidin Exhibits Potent In Vitro Antiviral Activity Against SARS-CoV-2. We will be updating on IPIX when more details emerge so make sure you are subscribed to Microcapdaily so you know what’s going on with IPIX.

Subscribe to Our 100% Free Penny Stock Newsletter. We Have Something Big Coming!

Disclosure: we hold no position in IPIX either long or short and we have not been compensated for this article.

You may like

-

Innovation Pharmaceuticals Inc (OTCMKTS: IPIX) Breaking Out as Biotech Reports Brilacidin Inhibits Omicron, Delta, Gamma and Alpha SARS-CoV-2 Variants Based on In Vitro Testing

-

Continued Success of Brilacidin Lifts Innovation Pharmaceuticals Inc (OTCMKTS: IPIX)

-

Brilacidin; Innovation Pharmaceuticals Inc (OTCMKTS: IPIX) Rising Fast on Compelling RBL Data

-

Brilacidin; Innovation Pharmaceuticals Inc (OTCMKTS: IPIX) The Bull Has Awoken

-

Brilacidin Data Lifts Innovation Pharmaceuticals Inc (OTCMKTS: IPIX)

-

Scientific Rationale for Brilacidin Boosts Innovation Pharmaceuticals Inc (OTCMKTS: IPIX)

1 Comment

Leave a Reply

Cancel reply

Leave a Reply

Featured

Clean Vision Corp (OTC: CLNV): Overcoming the Plastic Waste Crisis

Published

3 months agoon

January 18, 2024

Clean Vision Corporation (OTC: CLNV) has experienced several interesting developments recently, but it hasn’t noticeably influenced the market with any substantial gains. Nonetheless, we believe it’s worth providing an update on the company given it’s been a few months since our last mention. In today’s discussion, we’ll explore a variety of updates and their significance, with aim of providing insight on what to expect for 2024.

Background:

Clean Vision is led by Dan Bates, and their goal is to tackle the global plastic waste crisis head-on. Their wholly owned subsidiary, Clean Seas, has developed the Plastic Conversion Network (PCN), a groundbreaking technology aimed at diverting millions of tons of waste plastic from landfills, incineration, and oceans. The PCN converts this plastic feedstock into clean fuels and green hydrogen, significantly reducing reliance on fossil fuels and lowering the carbon footprint.

For a brief 2 minute overview on the company, feel free to reference the video CLNV’s subsidiary put together on YouTube. Here’s the link.

Clean Seas utilizes proven pyrolysis technology to produce environmentally friendly products, which are sold to multinational petrochemical companies, driving the circular plastic economy. Operational PCN facilities are already in place in Morocco and India, with additional conversion facilities in development across West Virginia, Arizona, and Southeast Asia. Long-term feedstock supply agreements exceeding one million tons of waste plastic annually have been secured at no cost.

Their recently trademarked brand, AquaH®, is produced in their PCN. According to the release, it offers a differentiated green hydrogen product from carbon-neutral sources. Currently, hydrogen is predominantly produced through methods that involve fossil fuels, which of course contributes to global carbon emissions. Furthermore according to Deloitte’s 2023 global green hydrogen outlook, this could be a $1.4T annual market by 2050.

$65 Million Plastic Conversion Facility:

CLNV is making big moves in West Virginia and according to the release on October 24th, 2023, they’ve brought in some serious players—CDI Engineering Solutions and ERM—to help out with their Clean-Seas West Virginia project.

CDI has over 70 years of experience integrating engineering, design, project support, procurement and construction management services to the energy, chemicals and electrical infrastructure markets.

ERM is the world’s largest advisory firm focused solely on sustainability, offering environmental, health, safety, risk and social expertise for more than 50 years with more than 8,500 dedicated professionals operating across 40 countries.

The plan is to kick things off in 2024, turning 100 tons of plastic every day into recycled plastics and clean fuels. It’s a hefty project with a $65 million investment, creating over 200 jobs initially. And they’re not stopping there—they want to scale up to 500 tons of plastic per day over time.

West Virginia Governor Jim Justice is also on board, throwing over $12 million in state incentives to support the project.

Governor Jim Justice made a reference to Clean Seas in his state of the union address. If you want to catch the mention, go to 34:15 in the video. The three minutes leading up to it are also worth reviewing.

Subscribe to Microcapdaily.com Right Now by entering your Email in the box below.

Subscribe to Our 100% Free Penny Stock Newsletter. We Have Something Big Coming!

Launches Global Operations:

CLNV made another significant advancement, planning to launch waste plastic conversion facilities in the European Union, Eastern Europe, and Southeast Asia. This will be accomplished through their new subsidiary, Clean-Seas Partners UK Limited (CS-UK), who of course shares the same vision of creating sustainable solutions to the global plastic pollution crisis.

Under the leadership of Managing Director Shaun Wootton, CS-UK will play a crucial role in strategic project development and investment facilitation, leveraging established relationships in the Middle East, Southeast Asia, and Europe.

To fortify effective governance and strategic direction, CS-UK is assembling a distinguished board with internationally recognized figures in banking, sustainability, and energy. This approach aims to have a diverse and experienced board guiding CS-UK in realizing its vision of promoting sustainability and environmental stewardship across diverse regions.

$340 Million Bond Offering:

CLNV even announced they partnered with a global advisory firm, Grant Thornton, to issue up to $340 million in Green Bonds. This is the world’s sixth-largest network of independent accounting and consulting firms, employing 62,000 people in more than 130 countries and had revenues of $6.6 billion in 2021. These bonds will fund the expansion of Clean Vision’s Plastic Conversion Network (PCN) under the “Clean-Seas” initiative worldwide, aimed at combatting plastic pollution on a global scale.

With the Green Bond’s net proceeds, CLNV plans to deploy at least six plastic waste conversion lines globally, with strategic locations in West Virginia, Arizona, Southeast Asia, and expansion in Morocco. The Green Bond is also expected to attract environmentally conscious investors, setting a new standard for corporate responsibility.

$15M Government Loan:

Lastly, under the capable management of Huntington Bank, CLNV has recently secured a $15 million government loan. What sets this apart is that the loan is FORGIVABLE.

A forgivable loan is a type of loan where the borrower is not required to repay the borrowed amount under certain conditions. Typically, these conditions are related to the borrower meeting specific criteria, such as using the funds for approved purposes, maintaining certain employment levels, or achieving predetermined goals. If the borrower fulfills these conditions, the loan is forgiven, and they are not obligated to repay the borrowed amount. Forgivable loans are often used as an incentive or support for specific activities, such as job creation, small business development, or other initiatives that contribute to economic growth or community welfare.

Not to mention it won’t result in any dilution for shareholders. This is an unexpected and uncommon accomplishment for an OTC company. Securing a government loan of this size without any dilution is truly impressive.

Conclusion:

CLNV has made impressive strides tackling the global plastic waste crisis, especially given their valuation of merely $22.65 million. The team has swiftly achieved key objectives, including a $65 million plastic conversion facility in West Virginia, global expansion through Clean-Seas Partners UK Limited, a $340 million Green Bond Offering, and a remarkable $15 million forgivable government loan. The vast $1.4 trillion market they’re tapping into offers an interesting opportunity with current indicators looking positive. Nevertheless, it’s crucial to acknowledge that there is still significant work ahead, and the team needs to maintain consistent execution to turn this potential into a reality.

We will update you on CLNV when more details emerge, subscribe to Microcapdaily to follow along!

Subscribe to Our 100% Free Penny Stock Newsletter. We Have Something Big Coming!

Disclosure: We have not been compensated for this article/video. MicroCap Daily is not an investment advisor; this article/video does not provide investment advice. Always do your research, make your own investment decisions, or consult with your nearest financial advisor. This article/video is not a solicitation or recommendation to buy, sell, or hold securities. This article/video is our opinion, is meant for informational and educational purposes only, and does not provide investment advice. Past performance is not indicative of future performance.

Picture by pasja1000 from Pixabay

Featured

Meta Materials (NASDAQ: MMAT): More Due Diligence and Exploring Latest Developments

Published

3 months agoon

January 16, 2024

Meta Materials (NASDAQ: MMAT) witnessed a significant uptick in trading activity on January 16th, 2024, resulting in a notable 20% increase in its stock value by market close. Intrigued by this surge, we explored various sources, including press releases, SEC filings, and social media, to identify the catalyst behind this sudden gain.

Unexpectedly our research revealed no recent material releases. Instead, the surge seems tied to an announcement from a few days ago that didn’t grab much attention at first. As time passed, it started generating more buzz but there’s still a lot more to dig into and a number of ideas to consider for today’s rally.

If you haven’t caught up on our previous analyses of MMAT, you can find the overview here. In this report, we aim to explore the cause-and-effect dynamics of recent events, offering insights that might illuminate expectations for Meta Materials in the near future.

Background:

If you’re new to MMAT or haven’t been a long-time follower, let’s kick things off with a quick intro to the company.

Meta Materials stands at the forefront of advanced materials and nanotechnology. Their focus is on pioneering novel products and technologies utilizing sustainable and innovative scientific approaches. The interesting part is their advanced materials have the transformative power to enhance a variety of common products, infusing them with heightened intelligence and sustainability.

Leveraging its technology platforms, they’re capable of empowering global brands in creating cutting-edge products that elevate overall performance.

Their technology has application across multiple industries including aerospace and defense, consumer electronics, 5G communications, batteries, authentication, automotive, and clean energy. Their agreement with Panasonic is certainly a great start to empowering their growth in one of many verticals. Overall the TAM is ~$32B and with current growth rates, it’ll increase to a whopping ~$61B by 2026.

MMAT’s goal is to shape a smarter and more sustainable world. If you look through their presentation, you can continue to evaluate the many ways their technology transforms everyday lives. We highly suggest you take a look.

Additional Resources:

- @LauraLoomer’s video on MMAT

- @metaheadj’s post on X, displaying Rob Stone‘s response update for an investor

Subscribe to Microcapdaily.com Right Now by entering your Email in the box below.

Subscribe to Our 100% Free Penny Stock Newsletter. We Have Something Big Coming!

What Happened:

So, MMAT issued a press release on January 11th, 2024, announcing a proposed settlement with the Securities and Exchange Commission (SEC) concerning an investigation related to the Torchlight Energy Resources, Inc. and Metamaterial Inc. merger.

According to the release, The company has extended a settlement offer (Proposed SEC Settlement) to the SEC’s Division of Enforcement. This proposed settlement aims to address concerns regarding antifraud, reporting, books and records, and internal accounting control provisions of securities laws. It is important to note that the Proposed SEC Settlement is contingent on approval by the SEC Commissioners, and the company cannot predict the approval timeline.

If accepted, the Proposed SEC Settlement would involve the SEC entering a cease-and-desist order and the company paying a civil money penalty of $1 million over a one-year period in four installments. Notably, the company would neither admit nor deny the findings outlined in the Order.

The company’s board of directors and management team view the Proposed SEC Settlement as beneficial for shareholders. If approved, it is expected to remove uncertainty surrounding the investigation, enabling the company to focus on advancing its business objectives.

So What:

If you’ve just read through the announcement and are confused, you’re not alone. It appears that many investors may have mis-read the press release, thinking that the SEC was being punished and MMAT was reaching a settlement agreement, but it appears to be the other way around.

In the event of approval, the company is obligated to pay a civil money penalty of $1 million. This penalty would be paid in four installments over the course of one year, following an agreed-upon payment plan. However, the PR also notes that the company cannot predict with certainty whether or when the Proposed SEC Settlement will even be approved by the SEC Commissioners.

According to another user on X, @AShortSqueeze, MMAT’s initial analysis has potentially revealed the motherload of counterfeit shares.

But if you scroll through the comments, you’ll see other users pointing out that this information is actually old news. This is just one of many widely circulated posts that might have been misunderstood.

Significant Coverage:

Another theory suggests that a notable influencer in the financial space, @MoonMarket_, has set their sights on the company and is conducting additional due diligence. With a substantial following of almost 75K users, the influencer’s involvement could have contributed to a significant fluctuation in today’s trading session. It’s important to recognize that X is packed with plenty of financial influencers, and blindly following their moves can be risky. Many are involved in day trades, momentum trading, or at least contemplating such strategies.

Conclusion:

The buzz around MMAT today seems fuelled by a mix of misrepresented themes and recycled news, creating the illusion of fresh, imminent developments.

As per usual, the magnitude of MMAT’s technology and potential integrations across various verticals continues to create a roar of excitement. On another front, we’re also continuing to see speculation about a short squeeze due to substantial amounts of counterfeit shares.

For now, patience is key and we suggest closely monitoring developments. MMAT especially tends to be quite volatile.

Disclosure: We have not been compensated for this article/video. MicroCap Daily is not an investment advisor; this article/video does not provide investment advice. Always do your research, make your own investment decisions, or consult with your nearest financial advisor. This article/video is not a solicitation or recommendation to buy, sell, or hold securities. This article/video is our opinion, is meant for informational and educational purposes only, and does not provide investment advice. Past performance is not indicative of future performance.

Picture by StartupStockPhotos from Pixabay

Featured

Integrated Cannabis Solutions’ (OTC: IGPK) 633% Surge: Exploring Catalysts, Company Overview, and Growth Potential in 2024

Published

3 months agoon

January 12, 2024

Integrated Cannabis Solutions (OTC: IGPK) has undergone a remarkable uptrend, surging an impressive 633% since December 11th, 2023, with 166% of that surge taking place across yesterday’s trading session and today, January 11th, 2023. Both days have been marked by unprecedented volume – Yahoo Finance reported an almost 30x increase, with 115,867,027 shares traded by close yesterday. We’re already seeing 90,092,317 shares traded this morning and it’s just barely noon. Today we’ll explore the catalysts behind the surge, offer a comprehensive overview of the company, and evaluate IGPK’s potential for sustained growth throughout 2024.

Background:

Let’s get straight to it. IGPK is the result of a recent reverse merger with Integrated Cannabis Solutions and JFH Digital E-Commerce Corp. The first thing you’ll notice is finding the website isn’t a walk in the park, we’re fairly certain there isn’t one yet, at least one that will help in any way related to more investment information. Your best bet for more any information is to check out IGPK’s OTC Market page for details, but even the company description on there is not accurate. We’ve mainly found the following information through filings, IGPK’s Twitter, and other online users.

Keep in mind this breakdown might not be flawless given we’re piecing it together mostly from what folks on X are saying. But we’ll try our absolute best to lay it all out for you.

IGPK appears to have been a shell for little while until JFH stepped in. A user on X, @stockplayer30, broke it down fairly simply, stating that the shell’s slate was wiped clean, cancelling all notes payable and any debt. Whether it’s a promissory note, convertible note, or convertible debenture, the main point is they ditched all debt. JFH has an opportunity to start fresh, and it certainly makes this deal a lot more interesting.

Just a heads up, it’s a Chinese merger. If the idea of a Chinese leadership team makes you a bit wary, you might want to pause here. However if you were in the trading game during the summer of ’23, you probably remember those crazy spikes in some Chinese Nasdaq deals. And get this – no big press releases or SEC filings to explain those sudden jumps either.

Subscribe to Microcapdaily.com Right Now by entering your Email in the box below.

Subscribe to Our 100% Free Penny Stock Newsletter. We Have Something Big Coming!

Company Description:

Onto what the company actually does. According to @SuperRobotOTC on X, this is a digital e-commerce company based in China, here’s a link to their e-commerce website. This user also put together a great overview of the company on YouTube, if you’d like to watch something informative in video format, click here.

Another user, @igal_n, found a blurb on the company that states, “Junfenghuang (JFH) is a digital asset. It is a token issued by Uplus Future Company with the help of blockchain technology. It has no direct relationship with the original equity”.

The Potential:

What makes this story extremely interesting is the sheer magnitude of how large JFH is, the intrinsic value does not appear to be valued accurately in the market, given it’s only freshly merged into IGPK’s tiny shell company on the OTC.

Their Gross Merchandise Value (GMV) is heading north of 50 billion yuan, and post-merger profits from service outlets are looking at a hefty 10 billion yuan – yes, billion with a B.

Steering the ship is a leadership team featuring President Wang Dejun, Treasurer Xie Weiji, and Director Yang Lanfang. With a whopping 750 subsidiaries, 250,000 merchants, and 30 million registered users. We’ve also heard from other sources that the registered users could be nearly double that, coming in at 50 million registered users.

These numbers are substantial for a company with a $7 million market cap. Looking ahead, it won’t be shocking if IGPK sets its sights on moving up to a bigger exchange like NASDAQ. It’s no secret they’re already in the big leagues – or it at least appears so. If that were the case, they’d of course have enhanced credibility, more visibility, and increased access to capital with institutional funding.

The App:

Now, you might be wondering, “Sounds cool, but it’s a Chinese merger with a whole setup on the other side of the planet. Can we trust this info?” @SuperRobotOTC has also gone the extra mile by downloading the app, and gave us the lowdown in video format. On top of the SEC filings, this is an added layer of trust & credibility we can attribute to this new venture. Here’s the link to the video.

Conclusion:

Fortunately it appears IGPK is still for the most part flying under the radar. There’s not even a proper website or accurate update on IGPK’s OTC Market overview to tell us what the company even entails. But here’s the silver lining – that might mean you’re still early. The intrinsic value of IGPK appears strongly disproportionate to its current value in the market.

Our advice? Keep a close eye on IGPK’s journey as it takes on this exciting phase of growth and exploration. It’s likely this story will catch wind quickly and it could be a great time to take advantage. As @SuperRobotOTC eluded to in his video, this could be the OTC’s largest merger, with a potential $70B valuation.

We will update you on IGPK when more details emerge, subscribe to Microcapdaily to follow along!

Subscribe to Our 100% Free Penny Stock Newsletter. We Have Something Big Coming!

Disclosure: We have not been compensated for this article/video. MicroCap Daily is not an investment advisor; this article/video does not provide investment advice. Always do your research, make your own investment decisions, or consult with your nearest financial advisor. This article/video is not a solicitation or recommendation to buy, sell, or hold securities. This article/video is our opinion, is meant for informational and educational purposes only, and does not provide investment advice. Past performance is not indicative of future performance.

Picture by geralt from Pixabay

Recent Posts

Clean Vision Corp (OTC: CLNV): Overcoming the Plastic Waste Crisis

Meta Materials (NASDAQ: MMAT): More Due Diligence and Exploring Latest Developments

Integrated Cannabis Solutions’ (OTC: IGPK) 633% Surge: Exploring Catalysts, Company Overview, and Growth Potential in 2024

Sonoma Pharmaceuticals (NASDAQ: SNOA): Potential Surge to Speculations – What Lies Ahead?

1847 Holdings (NYSE: EFSH) Soars: Insights, Acquisitions, and What Lies Ahead

Trending

-

Uncategorized1 year ago

Uncategorized1 year agoMeta Materials Inc (OTCMKTS: MMTLP) Enormous Short Position in Trouble as Next Bridge Hydrocarbons Set to Stop Trading (George Palikaras & John Brda on Corporate Action)

-

Micro Cap Insider3 years ago

Micro Cap Insider3 years agoMedium (KOK PLAY) The Parabolic Rise of Metal Arts (OTCMKTS: MTRT)

-

Media & Technology3 years ago

Media & Technology3 years agoHealthier Choices Management Corp. (OTCMKTS: HCMC) Powerful Comeback Brewing as PMI Patent Infringement Lawsuit Moves Forward

-

Media & Technology3 years ago

AMECA Mining RM; the Rise of Southcorp Capital, Inc. (OTCMKTS: STHC)

-

Media & Technology3 years ago

Media & Technology3 years agoSNPW (Sun Pacific Holding Corp) Power Brewing: 50MW solar farm project in Durango Mexico MOU with Atlas Medrecycler 48,000 SF New Partnership Queensland Australia Solar Farm.

-

BioPharma2 years ago

BioPharma2 years agoAsia Broadband (OTCMKTS: AABB) On the Move Northbound Since Sub $0.08 Dip as Crypto Innovator Elevates AABB Crypto Exchange & Enters the NFT Space

-

Uncategorized1 year ago

Uncategorized1 year agoMeta Materials Inc (OTCMKTS: MMTLP) Short Squeeze S-1a4 Filing Signals S1 Approval Could Be Days Away (Next Bridge Hydrocarbons Spin-Off)

-

BioPharma2 years ago

BioPharma2 years agoHumbl Inc (OTCMKTS: HMBL) Major Reversal as Powerful Advisor Rejoins the Team & Looks to Uplist to Major Exchange

John Bach

February 20, 2021 at 8:27 am

BOE… sorry to tell you but your article on Innovation Pharmaceuticals and Brilacidin….is incorrect…

the ARTICLE published from George Mason University … IS “PEER REVIEWED” and published

see link: https://www.mdpi.com/1999-4915/13/2/271